Restructuring & Insolvency

Restructuring Opportunities arising from the Pandemic

Lower costs, less time, reduced risk.

Companies with liabilities over $1 Million

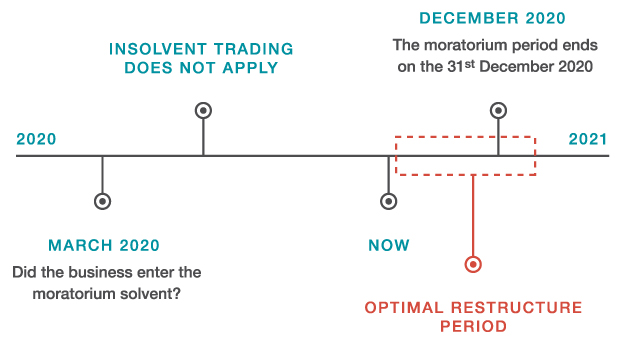

The COVID moratorium presents a unique restructuring opportunity for companies that were solvent or arguably solvent in March 2020 when the insolvent trading laws were suspended.

4 Key benefits:

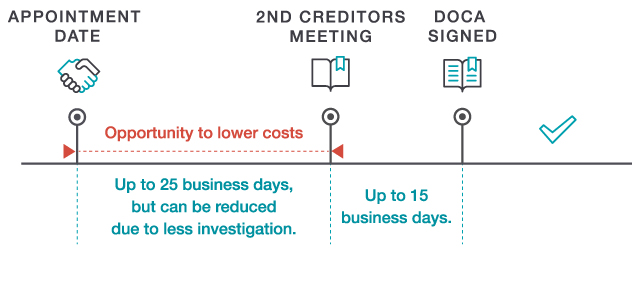

- The voluntary administrator’s investigation requirement is greatly reduced because the question regarding insolvent trading will be moot or of little consequence. This enables the VA period to be shortened and lowers costs.

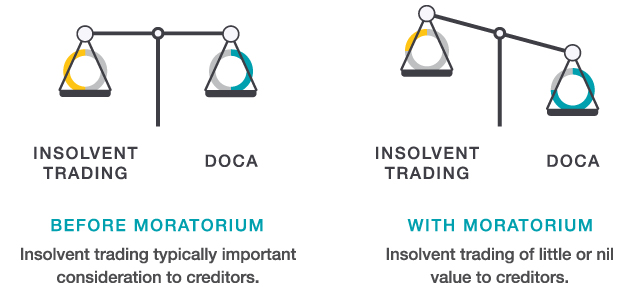

- The absence of a possible insolvent trading claim against directors reduces the potential return to creditors in liquidation. The commercial threshold for a proposed DOCA is reduced accordingly.

- Removal of the insolvent trading variable means directors can pursue a restructure with greater confidence that creditors will respond favourably. It will also be easier for the administrator to recommend the restructuring plan.

- The pandemic’s broad economic impact means creditors will be inclined to be sympathetic to the company’s financial distress. The stigma of the VA’s process will be reduced + last for a shorter period. The decision to restructure will instead likely be commended.

Perceived Value

Roadmap Through Covid

The optimal time to restructure.

The DOCA Timeline

Reduced investigations can shorten the convening period.

Companies with liabilities under $1 Million

“the most significant reforms to Australia’s insolvency framework in 30 years”

The government’s strategy to manage the pandemic’s economic fallout includes a comprehensive set of insolvency laws for small business expected to be introduced on 1 January 2021. The laws are a significant departure from Australia’s previous one size fits all model and are aimed at enabling the company to stay in business and avoid winding up.

For small businesses, the new regime is designed to be simpler and more cost-effective. Importantly, owners will now be able to remain in control of their business during the restructure process. This feature does not exist in the voluntary administration pathway.

Companies wishing to access the new laws must have less than $1 million in liabilities. Where liabilities exceed this amount, ‘pre-restructure’ planning may be possible.

Another requirement is that employee entitlements must be paid up. Cashflow planning prior to the restructure may therefore be needed to deal with superannuation contributions that are due and payable.

If restructuring is not possible, the new insolvency laws include a simplified liquidation process for small businesses.

If you would like to know more about your restructuring Opportunities arising from the Pandemic

If you would like to know more download here our in-depth read on possible Restructuring Opportunities arising from the Pandemic.

If your business is experiencing financial difficulty, contact us to arrange a free, no-obligation discussion to give you clarity on your position and options available.